What is a Letter of Credit

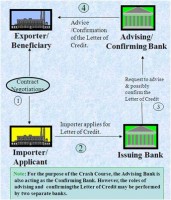

Letters of credit are often used in international transactions to ensure that payment will be received. Due to the nature of international dealings including factors such as distance, differing laws in each country and difficulty in knowing each party personally, the use of letters of credit has become a very important aspect of international trade. The bank also acts on behalf of the buyer (holder of letter of credit) by ensuring that the supplier will not be paid until the bank receives a confirmation that the goods have been shipped

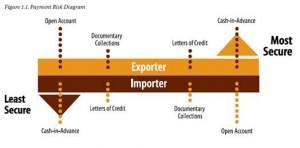

Letter of credit, in a broad perspective, is one of the payment methods in international trade. Some of the other payment methods in international trade are Cash-in-Advance, Documentary Collections and Open Account. All of these payment methods inherit different risk levels for exporters and importers. Letters of credit is the only payment method, which has a balanced risk structure for both parties.

Figure 1: Payment Risk Diagram

Above we have explained that letters of credit can limit the risks of importers and exporters. However, how can letters of credit achieve this? Letters of credit can balance the risks of exporters and importers because responsibility of LC operations is given to a third party, to the banks. We have explained this later in several articles on the subject.

- Basic Letter of Credit Transaction

- International Letter of Credit Consultancy

- Letter of Credit Documents

- Parties to Letters of Credit

- Risks in Letters of Credit

- Types of Letters of Credit

- Revocable and Irrevocable Letters of Credıt

- Transferable Letter of Credit

- Standby Letters of Credit

- UCP 600

- ISBP

Definition of Letter of Credit

A letter from a bank guaranteeing that a buyer’s payment to a seller will be received on time and for the correct amount. In the event that the buyer is unable to make payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase.

“Credit means any arrangement, however named or described, that is irrevocable and thereby constitutes a definite undertaking of the issuing bank to honour a complying presentation.” (UCP 600, article 2)

This letter of credit definition is taken from the UCP 600 (ICC Uniform Customs and Practice for Documentary Credits) which is the latest version of the rules published by ICC (International Chamber of Commerce ) regulating the letters of credit operations all around the world.

Role of the ICC and UCP in Letters of Credit

International trade is exchange of capital, goods, and services across international borders between people who belong to different languages, cultures and laws. As letters of credit are a payment method of international trade it is obvious that standardized rules are needed to govern letters of credit in a global scale to make sure that letters of credit transactions run smoothly. ICC, International Chamber of Commerce, is the organization that publishes the standardized rules. The rules, which are called UCP, Uniform Customs and Practice for Documentary Credits, are revised regularly. At the time of this text, sixth version of the UCP rules is in force.

To learn more about our offers go to the Bank Instrument Page and choose the exact Instrument you are looking for.

Sources for all Articles on the subject are; ICC, Wikipedia, Investopedia and banks.