Venture Capital (VC) is financial capital provided to early-stage, high-potential, high risk, growth startup companies. The venture capitalfund makes money by owning equity in the companies it invests in, which usually have a novel technology or business model in high technology industries, such as biotechnology, IT, software, etc. The typical venture capital investment occurs after the seed funding round as growth funding round (also referred as Series A round) in the interest of generating a return through an eventual realization event, such as an IPO or trade sale of the company. Venture capital is a subset of private equity. Therefore, all venture capital is private equity, but not all private equity is venture capital.

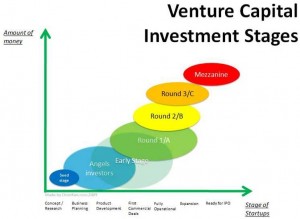

Below the graph is showing a very typical scenario for the life span of funding a start up.