At Economic Consultants we have been working for more than 30 years helping companies with their funding. We have a huge global network enabling us to find support for companies in all sectors.

Different companies need different solutions and no case is the same. However there are some basic matters that are common to all and ALL Professional Investors have their set of criteria, which has to be met in order to get their attention. As for companies the same goes for investors they come in all sorts and shades. Some are willing to have a look at your case as you have prepared it, others demand a long range of items which have to be met before they even look at it.

In order for our clients to enable themselves to get into a position where they actually can present their project, get attention and achieve what they are looking fore, we have established the Economic Consultants Funding Program.

We undertake funding assignments from companies from an early stage position to mature level. However it is important for clients to understand where they are in their life cycle and what’s needed to go to the market asking for funding.

To help our clients understanding this very important issue, we have made a document called “Investor Ready?”.If you want to be successful you have to make sure that you comply with the points described, and that your documentation can survive all questions asked from an investor.

There is little use going to the market only to experience being kicked out due to a sloppy prepared presentation and poorly underlying documentations. Solid preparations are the only way to success.

If a client finds it difficult to produce the required documentation we obviously are there to help. But we have also made it possible to manage most or all of it yourself by producing a number of Templates, which you can pick up from our web site for free.

Our funding program is meant to fit all companies. You decide yourself what part of the program you would like to choose and we will carry out the different task for you.

When both parties have agreed to the scope we will enter into an agreement (The EC Funding Program Agreement) determining the steps and details for how we together shall achieve the goal set forth.

Funding Program

Our Funding Program consists of different options to choose from, depending on what the client is looking for and the seize of the funding. There is also a significant difference between a start up and a well established company.

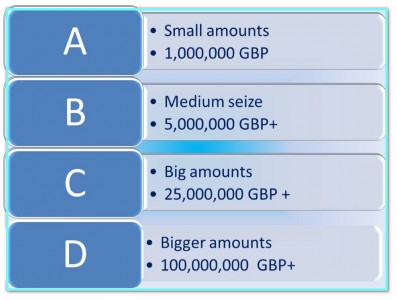

We are grouping the seize of the amount into four sections.

A – Small Amounts

We can work with amounts from GBP 500.000 to 1 million. This will mostly be for Start – ups. You will have to be prepared to give away everything from 10 to 33% of your equity to find investors interested.

B – Medium Seize

This is also typically Start – up seize amounts ranging from 1 to 5 million pounds. The equity you will be prepared to give up is in the range from 10 to 49%. This will always depend on the strength of the project and how you are presenting the exit strategy.

C – Big Amounts

When looking for funding in the area from 5 to 25 million pounds we are talking on established companies who has survived the starting period and are generating revenue. It is difficult to give a precise estimate as to the seize of equity the investor will be looking for. It will very much depend on where you are, how much you let go already and will always be a matter of discussion.

D – Bigger Amounts

This is a field where the shape of the client will determine how to arrange the funding. But we work with everything from debt, new issues and bond issues.

Agree on Program

The first step in the process is to agree on what program and seize of amount. Having determined that we will agree on a time schedule which again will be depending on how well prepared the client is.

Sign Program Agreement

When all details have been agreed and entered into the EC Funding Program Agreement we are ready to move to the next step.

Prepare Documentation

This is from the clients side the most demanding part of the process. A complete Business Plan must be prepared as step one. Then derived from the Business Plan a Company Presentation and an Executive Summary will be made together with a Term Sheet describing the details offered to the investors. There are certain standards which is required and we will not accept going to the market with documentation not living up to the standard required.

Approve Documentation

We will examine all documentation carefully and advice if improvements are necessary. We can always do this for the client and in our agreement the cost for all and any work taken on by EC is described. When we have all documentation ready we are set to go.

Carry out Investor Search

We have a number of resources to pick from when we are ready to present the client. But as mentioned earlier no case is the same and some times we will have a good picture on who the investor will be from the beginning, other times we will have to do a wider search among the investors we have on our database. The client must be prepared to spend everything from 3 to 12 months before we can close any deal.

Investor Negotiations

The ideal situation is to be ending up with two or more potential investors. Worst case is of course finding no one interested and being left with one can be a challenge. However we will offer out experience and assistance and normally we will end up with a good and acceptable agreement for both parties.

Cost and Fees

We will always look at any case presented to us for free. After having done the initial analyze we will suggest a program and in brief how we find it most likely to be able to find funding for the project. All travel and accommodation cost will be paid by the client when and if necessary.

Starting Fee

We are charging a minor starting fee. This is to cover the time we spend on going through the existing documentation and suggest improvements (if necessary).

The Starting Fee is GBP 1.500

Running Cost / Retainer

During the process lasting from 3 to 12 months we will be charging a retainer of GBP 2,000 per month. The retainer covers 12 hours work per month. If spending more than 12 hours, a fee of GBP 160 per hour will be added. Fixed fees can also be agreed.

Success Fees

We will charge a success fee of 1 to 5% of any amount raised. This is depending on the seize of the amount.

Payment Terms

Travel Cost, Starting Fees and Retainers will be invoiced and paid up front. If more time then initially agreed for the retainer have been used this will be calculated and added to next months up front retainer.

The success fee will be calculated and invoiced when the agreement with the investor has been signed. Payment due when the investors payment is hitting the clients account.

For a printable version of this document, please click below!