The European Crisis Rolls On!

Until we have seen the results of the Greek election mid June I don’t think we will see any significant changes in the markets, but perhaps downturns. Italy has crossed the negative line now reporting unemployment rates above 10% and there is no improvement in either Spain or Portugal.

Speculations as to whether Greece will leave the monetary union or not and what the effects will be is highly speculative and leading nowhere. I think most people realize that leaving will be a major catastrophe and more so for Greece then for the Union. Obviously deep worries on how one shall be able to regain growth are highly appropriate. However I think it is about time the Greek people realize that they have been having a party for more than 20 years and now it is over. They will simply have to start working again like the rest of us and they will also like the rest of us, be looking at carrying on until they are 70.

They will also have to cut their military spending. It is far oversized and do they still think that Turkey a NATO member and allied is ready invade? One could of course argue that it means jobs, but again far too many are already working in inefficient governmental institutions.

The first and only step to improve the government’s financial situation will be to impose a sustainable fiscal system; meaning they will have to start paying VAT and Tax something they most likely will have a problem with since they have never done it before.

Then betting on their traditional income sources like Tourism should work as well, but if they want to see growth they will have to stop sending hateful messages to Germany and England – who wants to go to a hostile country for their holidays? Then they rather go to Turkey.

Another great challenge is how to regain confidence in banks, not only in Europe but globally. As long as the banking industry knows that they can carry on as before because at the end of the day governments will pick up the bill after them, we will see no changes and the world have learned nothing. We must impose far stronger control, and the demand for substantial equity ensuring that they can stand tall if losses have to be taken. We simply have to force them to go back to their traditional task. It might perhaps be dull business and the share holders will not longer be anticipating big gains, but it will be a sound and secure business making sure that the world goes around.

The same goes for the Forex circus. For years we have gotten used to banks make big profits on their Forex business. This is in reality a big rip off with big spreads and commissions for doing what?

Hopefully more and more people will see that we will have to go back to a more conservative way of conducting our businesses. Inventions and production creating new places for people to work is the key to future growth. How on earth have anyone been able to believe that Europe can outsource any kind of production to the Far East and that the Service Industry would pick up all the people made redundant; it is being as naive as those believing that Christ will return tomorrow and dooms day is here again.

The Syrian Crisis Rolls on!

Hundreds die in Syria every day and have been doing so for months; more than 10.000 human beings have been killed, for what? Because they want to have the right to think and speak freely. Is that too much to ask? All of us living in the West take that for granted. So who is stopping the world from putting an end to this? Russia and China, both claiming to be democratic countries and both knowing that the more people experiencing real democracy, the more difficult it will be for them to carry on with their corruption and suppression.

We are living in a strange world. The civilised part of it is supposed to be running by and respecting the rules, but countries like Russia and China can do like they find best supporting their own dictatorial ways and financial interests. It makes me sick when I see their spokesmen spitting out their filthy lies. To them it does not matter if another 10.000 or 100.000 or even 1.000.000 dies. So why do we tolerate this? Because we are depending on their oil and industrial production? The fact is that they are more dependent of us then we of them, so why don’t we start realizing that and use it to put an end to all this? Well the answer is embarrassing and simple, no one in the West have the guts to stand up to them and tell them the truth – apart from the US who actually stands tall verbally, but seems to be slow in really make an effort to put it into practical politics – and I guess the reason is that they know they will be left alone with the Europeans finding all and any excuse not to provoke the gangsters.

I wonder for how long the world will have to live with their Lenin’s and Stalin’s and Hitler’s and Mao’s and let them slaughter innocent people!

Commodities

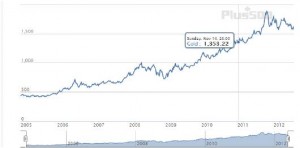

Gold has had an enormous growth in value over the last few years. If you look at the picture you will see that it has gone from US$ 434 per ounce end October 2005 to 1,883 an all time high, end August 2011. With the latest market changes we expect to raise again from end Mays price of 1,560. Interesting to see in the watch retail industry their prices have risen, but not to that extent. So perhaps they have kept their bottom line by increased sales.

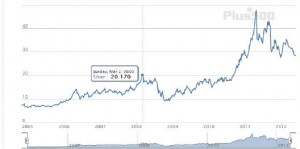

Silver has also seen a remarkable journey. Going from US$ 7.50 in November 2005, to an all time high level of US$ 47.90 on April 11th 2011. Interestingly to see, peaking out a bit earlier than gold. It has sustained its value for the last days trading and stopped at US$ 27.72 per ounce end May.

Currency

The Norwegian Central Bank is most likely still fairly happy about the situation. The NOK has kept its position slightly weaker to major currencies. GBP/NOK has kept on coming back for the last month as well and though still far to go going from 8.60 as lower level July last year to levels around GB£ 9.40 now is still a significant change. So trading GBP/NOK has given a lot of good opportunities. We keep our prediction that it still will keep on being quite volatile in the next 3 to 6 months.

Interest Rates

Very little happened over the last weeks in Europe and the US. Actually not much they can do with level rates close to the bottom. Both the EU and the US Central banks leaders are announcing no changes for the foreseeable future.

Indices

So how are the stock exchanges keeping up? Very dull for any long term investor I would say. Norway down from 392 to 354 over the last month, bringing us back to August 2008. Stockholm down from 1,045 to 954 the last month. The German 30, down from 6,282 to 6,032 and Madrid from 6,829 to 6,086. The Spanish exchange has actually not recovered from their 2009 levels. I had hoped to be able to report some positive changes in the UK, following a tight saving schedule as they are, but yet one can see no such changes. Level to day still pretty much as in September 2008.

Net Trading

Information and markets in 19 countries now available. Make the EC page your own homepage and have access to updated rates in all major markets. All major Indices, Stocks, Commodities, or Currency rates are there and with a click you can see the latest development or study historic data.

Now you can also follow your positions without sitting in the office, just a click on your mobile phone and you are in. Instruction for downloading the plus500 mobile app will appear on our Home Page very soon.

Latest on New Tech

Highly interesting ruling on what you can patent. The judge in Oracle’s copyright and patent suit against Google’s Android OS ruled that the allegedly infringing Java APIs can not be copyrighted. Therefore, Oracle has no case.

Judge William Alsup, who reportedly has coding experience, announced his decision on Thursday, saying that Google did not infringe on copyrights held by Sun Microsystems (acquired by Oracle in 2009) because those copyright don’t exist.

Oracle’s suit claimed that Google’s Android operating system was built on no less than 37 Java APIs that infringed on Sun Microsystem’s copyrights.

A jury earlier this month determined that Google did indeed infringe on the APIs in question, but the jury were operating under the assumption that said APIs were copyrightable in the first place.

Yesterday, Alsup overrode that decision, saying, “To accept Oracle’s claim would be to allow anyone to copyright one version of code to carry out a system of commands and thereby bar all others from writing their own different versions to carry out all or part of the same commands”.

Alsup continued, “No holding has ever endorsed such a sweeping proposition.” Are APIs a free-for-all resource? However, Alsup noted that “this order does not hold that Java API packages are free for all to use without license. Rather, it holds on the specific facts of this case, the particular elements replicated by Google were free for all to use under the Copyright Act.”

“Oracle’s claim would allow anyone to copyright one version of code to carry out a system of commands and bar others from writing their own versions to carry out all or part of the same commands.”

Google said in a statement: “The court’s decision upholds the principle that open and interoperable computer languages form an essential basis for software development. It’s a good day for collaboration and innovation.”

Oracle reportedly responded that the ruling will make defending IP rights all the more difficult going forward. They plan to appeal the ruling.

Other portions of the case could see Google paying as much as $150,000 to Oracle, a paltry victory when compared with the billions that Oracle hoped to win.

The jury also determined that Google did not infringe on two Sun Microsystems patents raised by Oracle in the suit. (The Guardian).

The Samsung Galaxy S3

is the Ferrari of Android phones, with a gorgeous 4.8-inch 720p resolution display, an impossibly slim and light casing and a quad-core engine that goes like stink. This super-premium phone is very expensive, and the more you push it, the quicker it guzzles battery juice. It’s certainly not a phone for everyone, but expect it to give the iPhone a good run for its money.

If you want any information on our exiting projects, you are more than welcome to contact us. Just check out the menu or contact us!!

If you want to have a printable version please click below;