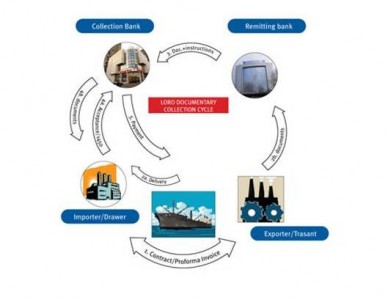

When you are in need of a Bank Instrument, it is important to understand how it works and the process. When you understand the system it is also easier to understand our offers.

This is how the transaction flow will be. It is important to check out the rest of our information to make sure you understand the transaction system.

A) The starting point of the letter of credit process is the agreement upon the sales terms between the exporter and the importer. Then they sign a sales contract. It is important to stress here that letters of credit are not a sales contract. Actually, letters of credit are independent structures from the sale or other contract on which they may be based. Therefore, it should be kept in mind that a good sales contract protects the party, which behaves in goodwill against various kinds of risks.

B) After the sales contract has been signed, the importer (applicant) applies for its bank to issue a letter of credit. The letter of credit application must be in accordance with the terms of the sales agreement.

C) If the importer and its bank reach an agreement together on the working conditions the importer’s bank (issuing bank) issues its letter of credit. In case the issuing bank and the exporter (beneficiary) are located at different countries, the issuing bank may use another bank’s services (advising bank) to advise the credit to the beneficiary.

D) The advising bank advises the letter of credit to the beneficiary without any undertaking to honour or negotiate. The advising bank has two responsibilities against to the beneficiary. Advising bank’s first responsibility is satisfy itself as to the apparent authenticity of the credit and its second responsibility is to make sure that the advice accurately reflects the terms and conditions of the credit received.

- The beneficiary should check the conditions of the credit as soon as it is received from the advising bank. If some disparities have been detected beneficiary should inform the applicant about these points and demand an amendment. If letter of credit conditions seem reasonable to the beneficiary then beneficiary starts producing the goods in order to make the shipment on or before the latest shipment date stated in the L/C. The beneficiary ships the order according to the terms and conditions stated in the credit.

- When the goods are loaded, the exporter collects the documents, which are requested by the credit and forwards them to the advising bank.

- The advising bank posts the documents to the issuing bank on behalf of the beneficiary.

- The issuing bank checks the documents according to the terms and conditions of the credit. In addition, the governing rules, which are mostly latest version of the UCP are taken into account.

- If the documents are found complying after the examination the issuing bank honours the payment claim.

- The documents transmit to the applicant. The applicant uses these documents to clear the goods from the customs.

To learn more about our offers go to the Bank Instrument Page and choose the exact Instrument you are looking for.