India – Strong growth continues!

India – Strong growth continues!

Analysts had predicted a 5.2% growth in Q2. But the results show a strong 5.5% growth. This is a quite impressing figure when looking at both neighbours and the West. However, there are concerns that a lack of reforms, slowing factory output and investment may hurt long-term growth.

“Whilst an upside surprise at 5.5 per cent, the pace of growth is undeniably below potential and validates the need for the government to address sluggishness in investment and external sector activity,” said Radhika Rao an economist at Forecast Pte.

India’s foreign exchange reserves fell from 2011 to 2012. This may have changed over the last months.

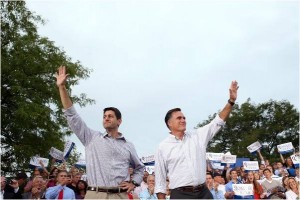

US Election!

GOP Paul Ryan gave a good impression when speaking at the Republican Congress in Tampa. Enthusiasm and basically sound fundamental views on economy, was a fresh breath. May be these are the pillars from where Mitt Romney are planning to create 12 million new jobs. So far I lack a good understanding of what Mr. Romney actually will do to change things, but the oncoming debates will obviously give a clearer picture.

After a rather embarrassing performance from the United States congressman and member of the House Committee on Science and Technology (of all things), Todd Akin, who said, while defending his anti-abortion stance during a St Louis television interview, “It seems to me, first of all, from what I understand from doctors, that’s really rare. If it’s a legitimate rape … aah … the female body has ways to try to shut that whole thing down. But let’s assume that maybe that didn’t work or something; I think there should be some punishment, but the punishment ought to be of the rapist and not attacking the child.”, I feel Republicans most likely still is living in the 17th century and the republicans’ stony view on abortions, is something we finally got rid of in North Western Europe many years ago.

Mr Ryan really gave a boost to both Mitt Romney and the party. Pity though that he has been forced into a humiliating U-turn over claims he was an unusually fast long-distance runner. A red-faced Ryan admitted on Saturday he didn’t run a marathon in under three hours, as he boasted last month on a nationally broadcast radio interview. The conservative congressman acknowledged he misstated his time by more than an hour. It seems like Sarah Palin is the fastest marathon runner on the Republican top candidate list over time, after all. But how fast or slow is actually not the point. The point is why would he with such a strong image have to lie about in after all such a minor issue? There is something called “Wishful thinking” and hopefully this can come under such a chapter – we would not like to se a VP having trouble with reality – especially not when it comes to economy!

Left wing party “SV” wants higher taxes on the oil industry!

Norway has been quite successful in building an Off Shore Service Industry. Today exports from these companies are three times the value of the Fish exports that in itself is rather big for a small country.

The country used to have a substantial paper industry as well, but due to tax systems upheld by the socialist government for years the industry is about to die.

Left wing SV recently came up with a thrilling idea, since Norway’s private Off Shore industry is doing so well, why don’t we increase taxes? Already paying 78% – why not just take it all? Luckily these people represent only around 4% of the voters!

China & Russia maintains their sick attitude in the Syrian conflict.

No need for changing the headline. As long as we have countries like China and Russia human lives will have no value – I do not think they even blink when reading the death toll.

Currency & Interest Rates

Norges Bank’s Executive Board decided today to keep the key policy rate unchanged at 1.5 percent.

“The Norwegian economy is still faring well, but inflation is low. External growth is sluggish and interest rates abroad are very low. Against this background, the key policy rate is kept unchanged at 1.5 per cent,” says Deputy Governor Jan F. Qvigstad.

Developments in both Norway and among trading partners have been broadly in line with expectations. Inflation in Norway has been slightly lower than projected and the Krone has recently appreciated somewhat. The expected upward shift in interest rates abroad has been deferred further ahead. At the same time, premiums in money and bond markets have declined.

“In June, the key policy rate was projected to remain at today’s level in the period to the turn of the year. New information does not warrant a change to this assessment.” says Deputy Governor Jan F. Qvigstad.

With a continued growth and new oil findings very little indicates a slow down in the Norwegian economy. The last finding is estimated to be may be the biggest ever found in the North Sea. Unemployment has fallen again and is now down to 2.6% with a figure of 12.600 new jobs. The challenge will remain to be how to balance the interest rate and the growth in wages.

Denmark lowered its interest rate to a historical low in July, obviously trying to stem what they have been seeing coming for some time now. Unfortunately we see no changes on the short term and the Danish Currency are trading at all time low 0.98 against NOK. With a budgeted deficit of 2.0% for 2013 they will really have to pull up their sleeves to get back on track again.

The Swedish Riksbank has its next meeting on September the 5th. They have had the same rep interest rate for more than a year. Most likely they will keep it as it is, but if lowered by 0.25% it may be read as also they have been faced with oncoming problems.

EUR/USD has picked up a bit over the last few days. Not much indicating that we will see major changes over the next month or two and historically it is a long way back.

The UK Inflation Report from August issued by the Governor was interesting reading. The next meeting to determine the level of the interest rate is September 6th and this will be given enormous interest. We have a number of unanswered questions.

In August he said “A year ago inflation was rising and heading towards 5%. It has now fallen to within touching distance of the 2% target. The big picture in today’s Report is of a further decline in inflation, as external influences fade and domestic cost pressures ease, and a gradual recovery in output.

Nevertheless we are navigating rough waters and storm clouds continue to roll in from the euro area.

Output has contracted in each of the past three quarters, but the underlying picture is probably not as weak as the headline data suggest. The extra bank holiday in June is likely to have reduced output in Q2 by around ½%, an effect that should unwind in Q3. And a large fall in construction output in the first half of the year, which seems at odds with survey data, is unlikely to be repeated. Even looking through these erratic factors, though, the underlying picture is that output has been at best broadly flat over the past two years, and has continually disappointed expectations of a recovery. In contrast, the labour market has remained surprisingly resilient in recent months. Private sector employment has grown robustly and unemployment has edged downwards. Although welcome news in its own right, the resilience of employment, combined with the weakness of output, means that productivity growth has been unusually low. That continues a recent pattern of both weak output and productivity growth that is difficult to explain. We cannot be sure how persistent that weakness will be, and that is one reason why the Committee has lowered its forecast for growth. A major concern for the Committee in recent months has been the rise in bank funding cost.”

No doubt the Olympic Games (still going on in full with the Paralympics on) have given a boost, but what happens now? Will we see a raise in unemployment? Will we see a raise in inflation? No doubt a 5% inflation rate will help reduce the British sovereign debts but over time it is also destabilising wages which again will turn into a negative spiral not needed now. On the 6th we will know more!

The Monetary Union situation!

In an interview with Dr Jens Weidmann, President of the Deutsche Bundesbank, with the magazine Der Spiegel, published on 27.08.2012, he had the following comments on progress in implementing reforms or lack of such in the troubled Latin countries.

“But that is already happening. Governments throughout southern Europe are cutting back spending and introducing reforms, but the financial markets are failing to recognise this progress and are driving up sovereign bond yields to dizzying heights”. Why do you oppose European Central Bank (ECB) President Mario Draghi’s wish to buy up large quantities of southern European government paper to ease the situation?

“I was critical of previous sovereign bond purchases – and nor was I alone in this. In my view, such a policy comes too close to state financing via the printing press. The central bank cannot get to the root of the problems in this way. It runs the risk of creating new problems.”

Doesn’t dogma sometimes have to be broken to prevent something worse from happening?

“It’s not about dogma. It’s about rebuilding confidence during a crisis of confidence, and it’s about key monetary policy lessons learnt from the past.”

Now you’re going to bring up German hyperinflation of 1923 again?

“No, the Maastricht Treaty draws on lessons learnt from European post-war history.

During the 1970’s, the central banks of many Western industrialised nations were held hostage to economic and fiscal policies, the idea being that 5 percent inflation is preferable to 5 percent unemployment. This led to inflation and unemployment rising simultaneously. Based on such experiences, the Euro system was geared solely to the objective of monetary stability, which is what the Bundesbank has always stood for.

Net Trading

Information and markets in 20+ countries now available. Make the EC page your own homepage and have access to updated rates in all major markets. All major Indices, Stocks, Commodities, or Currency rates are there and with a click you can see the latest development or study historic data.

Go to “Net Trading, Live Rates” (https://economic-consultants.com/global-trading/live-rates/) pick the country and language of your choice and get started. More than 1.000.000 users already!

Now you can also follow your positions without sitting in the office, just a click on your mobile phone and you are in. Instruction for downloading the plus500 mobile app.

Latest New Tech

Over the past month Apple has shown up in court to face Samsung on a number of patent infringement charges, claiming that Samsung has stolen a significant amount of intellectual property and should be punished for doing so. Apple has won all but one court case. In the United States a jury decided against Samsung and mandated that the company pay Apple over $1 billion in damages. Even so, Apple has filed another brief in a California court this time going after Samsung’s newer line of galaxy products. Typically Apple is winning in the US and lost in Japan.

Consumers around the world are responding to media reports, sounding off with heated opinions both for and against the iPhone maker, though it seems the majority are rooting for Samsung.

No doubt at all, Steve Jobs and his teams have been vital to the modern mobile phone. But what did he actually invent? How many ideas and thoughts have they stolen on their road to being IT giant no one in the world?

What has been worst to swallow is the way they always try to build a monopoly around their products and thus dictating prices.

Nothing is worse to the consumer than monopolies and nothing is worse for human kind than command economy systems, so thumbs up for Samsung – they make fantastic products at a lower price!

Samsung Galaxy S3 vs. iPhone 4S

The Samsung Galaxy S3 4.8” Super AMOLED screen with the 1280x720p resolution is pretty unbeatable. The iPhone 4S’ 3.5”, 960x640p display is Retina, but still doesn’t come close.

The Samsung Galaxy S3 is a shade lighter than the iPhone 4S, at 133g to 140g. However, the iPhone’s size makes it more hand and pocket compatible. The iPhone 4S feels more high-end than the S3 thanks to the choice of exterior materials, so Apple has it on the design front.

The S3 has a Qualcomm quad-core chip (international version) and a dual-core in the US. It has 1GB of RAM internationally and 2GB in the US. The iPhone 4S has a sparse 512MB and an 800MHz dual-core processor. It’s an obvious win for the S3 again. While both phones have 8MP rear cameras, the S3 1.9MP front camera trounces the 0.3MP Apple offering. The S3 also benefits from zero shutter lag and burst mode – both cameras have the same camera sensor – but the extra bells & whistles put the S3 in front.

The iPhone 4S non-removable battery is 1,420mAH, while the Samsung Galaxy S3 has a removable 2,100mAh battery. This battery gives three times as much talking as the iPhone’s, and the S3 also has support for an external micro SD card, as well as LTE and NFC, all missing in the iPhone.

The Samsung Galaxy S3 wins over the iPhone 4S, but this is because it was intended to compete against the iPhone 5. The iPhone 4S is over now, so don’t bother with it. If you really can’t wait for your

upgrade, get a S3. If, for some reason, you still fancy an iPhone 4S, hang on just a bit longer, as its price will go through the floor when the iPhone 5 looms into view.

Rumours are that September 21st will be the launching day for the new iPhone 5 from Apple!

At EC we have a number of new highly interesting projects going on. Obviously most of them are of a nature of public confidentiality, but we are engaged with new Stock Exchanges, Huge Real Estate Projects, Helicopters, Bio Tech, Energy, Boats, Yachts, Oil, and Commodities in general etc.

Latest on MEC

Buzz Aldrin and Edward “Ed” Nixon have accepted to join MEC Technical Advisory Board. Press release and more info will follow!

If you want more information on our exiting projects, you are more than welcome to contact us.

Enjoy the Paralympics – amazing to see what the contestants are able to give us!

LJ Myrtroen

Senior Partner